Maximize

yourmarginsefficiencyprecisionprofitabilityqualitymargins

Cloud based business solutions

for logistics and seafood

Improving your efficiency, flexibility and collaboration. We enable you to get more out of less, through every part of the value chain.

Want to get a demo? Click the buttons below!

Get started with our demo!

See how you can use our software – click below to get access to a demo of the core functionalities in Maritech Purchase & Sales:

Have you seen it yet?

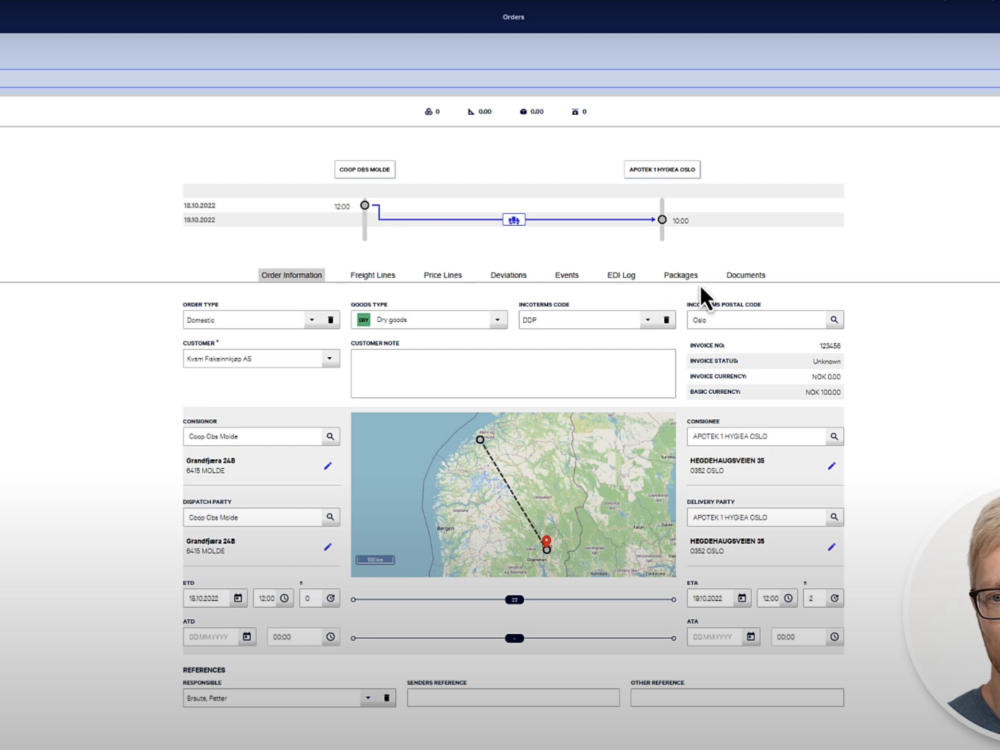

The new Maritech TMS gives you full control of all your transport assignments – with real-time updates in an interactive map. Optimise your transport management, with full overview of margins, emissions, and assignments.

Collaboration, tracking, planning, and documentation can now be done much easier and more efficiently than before.

You can seamlessly connect with your customers through the customer portal. You can also communicate effectively with your suppliers — directly from the system via EDI. We help you integrate Maritech TMS with the ERP system you use.

Take a look at the video to the right to get a taste of the system, and read more here.

New Customer Case with Matorka

“We see the technology as a key part of unlocking all the benefits of automation and digitalization in the processing plant, but also for traceability and as a significant part of food safety going forward.” – Christo Palleis, CEO, Matorka.

Matorka has implemented our cloud software Maritech Purchase & Sales in combination with Maritech Packing, integrated with dk Business Solutions.

Welcome to Cloud, Matorka!

Why Maritech?

Get to know some of our customers, and see why more than 500 seafood and logistics companies across Europe and North America have chosen our team and software.

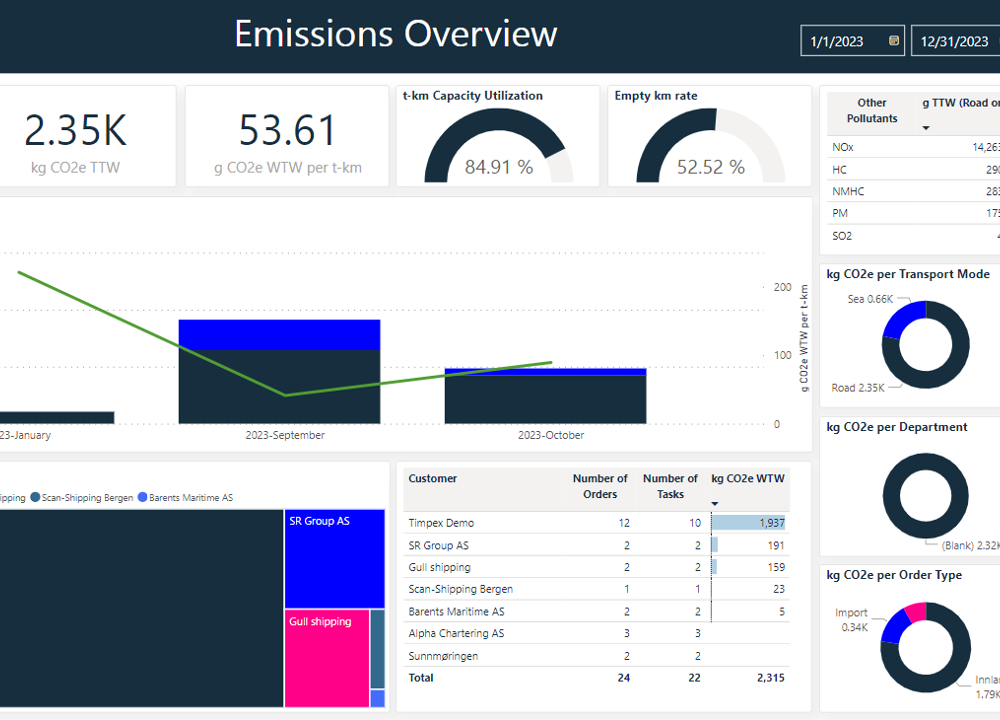

New! Maritech Sustainability Reporting for Seafood companies

Since 2021, many of our logistics customers have been using Maritech Sustainability Reporting – now it is also available for seafood companies!

Gain a deeper understanding, greener operations and better margins with transport related metrics like emissions per trip, leg and vehicle, combined with data from production and farming and/or fisheries. Full overview + detailed, real-time and historical data.

Maritech Sustainability Reporting -> Your fast-track to emission reductions.

Coast Seafood and Agile Logistics have recently implemented Maritech Sustainability Reporting – click here to see what they say.

Good fish, bad fish?

Using Maritech Eye™, you can now automate the quality assessment of your salmon or wild catch – with an objective eye, in industrial speed.

The solution is the first of its kind in the world, scanning through the fish, documenting quality with higher precision and speed than a human eye. Maritech Eye™ can for example detect and blood spots in redfish fillets, and sort whole round white fish by species and quality.

Take a look at the customer case video to the left to hear about how UR Seafood use Maritech Eye™ onboard their vessel Gudmundur i Nesi.

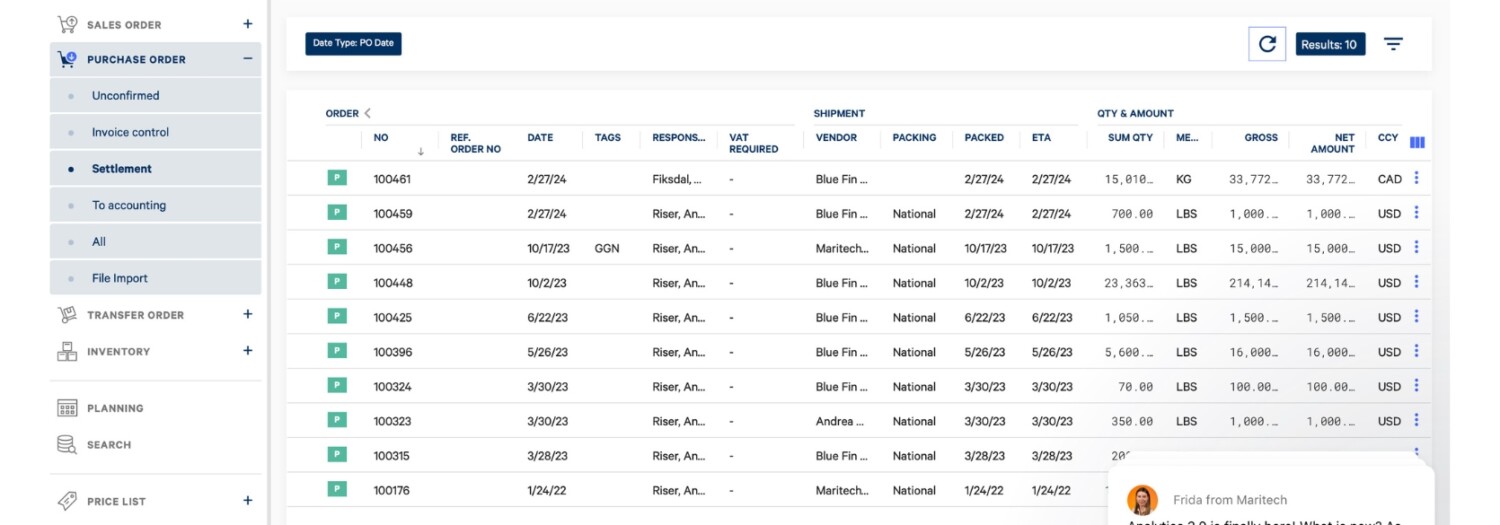

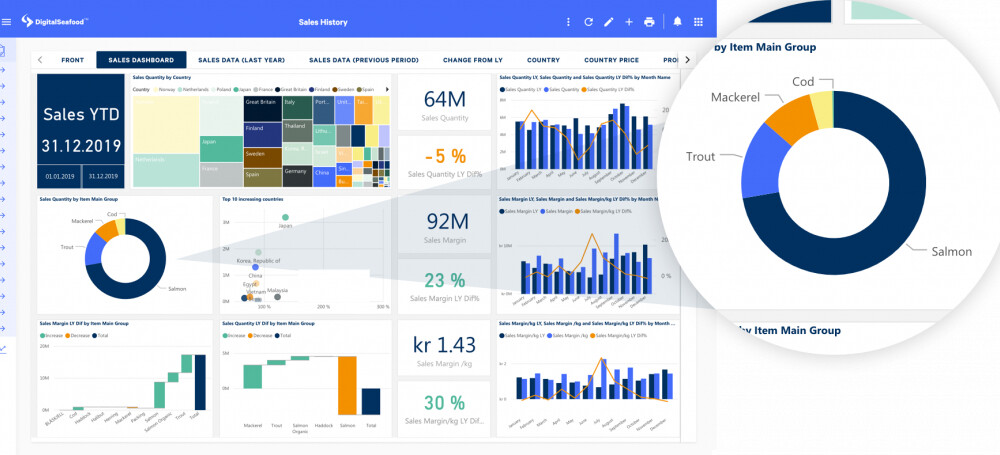

Do you sell seafood?

We know that you have crazy days and not a second to waste.

The good news is – there is an easier way, and you get better margins as well. With a complete set of new cloud-based ERP tools tailored for seafood trading, you can now automate many of the processes you may be handling manually today, for example in Excel sheets and Google Docs. Buy and sell seafood with full control of your inventory, margins, customers and vendors, and easy access to all the documentation and information you need.

Give us a nod, and we will show you how!

Get started with our demo!

See how you can use our software – click below to get access to a demo of the core functionalities in Maritech Purchase & Sales:

Tailored for you

Choosing a software partner dedicated to your industry is the easy path to the functionality you need, combined with better margins, and more time to focus on your business.

For more than 40 years, we have been a trusted advisor, software provider and innovator. The result; a unique blend of technological advances, in-depth competence, and knowledge of your core operational processes.